Get a Head Start with your 2023 Taxes: Year-end Tax Planning Strategies

CANVA – Jenn Miranda

The end of the year is a celebratory time for most people, a time of festivity and for many a time to breathe a sigh of relief to have made it through another year. In the business world the end of the year signifies the start of a new tax season. Although the sound and thought of tax planning or tax preparation does not fit in with the holiday joy and cheer of the season, in the business world this is an inevitable step that is highly necessary for any successful company/executive to start planning or preparing towards by the end of the last quarter of the year.

The end of year is the perfect time for executives to undertake strategic measures, such as tax planning strategies, to prepare for next year’s tax matters. The end of year is when business owners should assess their tax conditions for 2022 and look for ways to reduce, delay, or accelerate their tax liabilities. Furthermore, with rising interest rates, inflation, and ongoing market volatility, tax planning is more important than ever for business owners trying to manage cash flow while paying the least amount of taxes feasible over time.

Advanced tax planning is a smart business strategy and a pivotal part of financial planning. It gives great benefits for any business, large or small. Its primary concept is to save money and mitigate one’s tax burden. It ensures savings on taxes while simultaneously conforming to legal obligations and requirements. It also entails assessing the company’s current financial status, forecasting anticipated profit or loss for the next quarter, and planning ways to reduce taxes while increasing its worth.

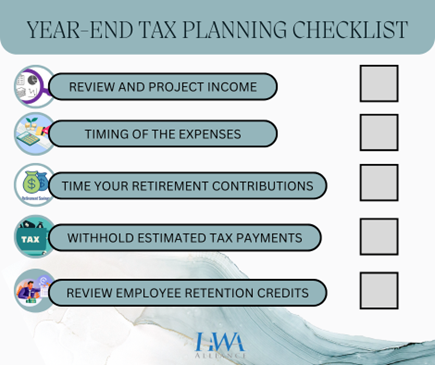

Making the fourth quarter a proactive tax planning time will prepare businesses for next year’s tax season, leading to healthy finance, company compliance, and business continuity. To help business owners be proactive in tax planning, here are some end-of-year tax-planning strategies that companies should consider in the entirety of their financial situation and ensure that all facets work cohesively to ensure that they pay the least amount of taxes during tax time.

Watch our video below or read the article underneath to understand more!

Five Key Considerations for Year-End Tax Planning (https://cnccpa.com/five-key-considerations-for-year-end-tax-planning-for-small-business-owners/)

Review & Project Your Income

Business owners should end the quarter by reviewing their current income and projecting future income for 2023. To set up for optimal success and to pay the least amount of taxes required by law, businesses need to know where they currently stand and where they are headed. An income projection lets them know what tax bracket they will be in for the upcoming year. The ideal place to begin is by looking at their income and deduction information from their last tax return, and then they can adjust it with new or current data. Based on their new information, they can calculate, or “project,” how much they will pay in taxes.

The benefit to projecting your business’s income is to either reduce the number of surprises for the future and/or to feel secure that you have adequately planned for them. An income projection gives a solid road map to predict estimated quarterly tax payments and plan for future expenses when sales might be lower, or there is reduced cash flow. In addition it reduces financial risk by forecasting a big-picture view of the entire business so the business can maximize profitable resources and minimize wasted ones.

Time Your Expenses

The strategy of timing income and expenses can potentially reduce business tax liability. Deferring income to the following year and speeding up deductible expenses into the current year can be a way to defer certain taxes. This same strategy can be applied if business owners expect to be in a higher tax bracket the following year when tax rates can increase. In this scenario, they would take the opposite approach—increasing income could allow more of their income to be taxed at the current year’s lower rate.

For example, consider the timing of equipment purchases. Section 179 of the IRS Tax Code allows business owners to deduct the cost of certain properties as an expense when the property is placed in service. This deduction can aid business owners by alleviating the big financial purchases they need to make. It’s key to implement this strategy in Q4 when they are reviewing and projecting the following year’s resources and need to time an expense for a deduction.

Time Your Retirement Contributions

If a business owner is yet to develop a retirement plan for his/her business or is not sure which chosen plan is the right one for them, they are most likely missing tax-saving opportunities. This could be anything from a SEP IRA to a Solo 401(k). Contributions made by employers are tax-deductible and are not subject to employment taxes. Choosing to offer benefits to their employees has been shown to increase recruiting and retention while simultaneously providing tax advantages and other incentives as a bonus to business owners.

If a company already offers benefits to their employees, they should consider timing their contributions by fully funding at year-end. The funds the company defers into a qualified retirement plan are not taxable until they begin withdrawing their tax-deferred savings. They can put extra funds into it at year-end to lessen their tax burden for the current year by reducing their taxable income. This is important if they are currently in a high tax bracket and/or foresee themselves being in a lower tax bracket in the future.

Withhold Estimated Tax Payments

The federal government requires all businesses to pay as they go through estimated tax payments. By splitting up the company’s tax payments each quarter, they’re softening their tax burden at the end of the year by avoiding paying one large bill. The estimated tax payment method enables business owners to keep a record of their expenses in the build-up to Tax Day and offset any costs that occur between this period and their final submission to the IRS. It’s important to note where the company currently stands in income so that they can use this information to determine whether they need to be paying more (or less) each quarter than they previously were.

Instead of making their estimates based on the entire year, consider calculating what the company should owe each quarter to make their payments as accurate as possible and avoid overpaying the government. This is especially important for business owners who have fluctuating income and cash flow throughout the year.

Review Employee Retention Credits

The Employee Retention Credit (ERC) was introduced in 2020 to help businesses affected by the COVID-19 pandemic. Since its release, there have been several modifications, and recently, the Infrastructure Investment and Jobs Act (IIJA), signed by President Biden in November 2021, retroactively eliminated some employers’ ability to claim an ERC for wages paid after Sept. 30, 2021. Despite all of this, many businesses are still eligible for the credit and have not filed for it. Don’t assume your business is not eligible. If you have employees or your business was affected by the pandemic, you could likely qualify for credit.

Tax planning and preparation does not have to be complex and challenging. With a little advanced planning and the help of an experienced tax professional, it can be a pretty simple task when planned out properly.

Let HWAA help you with your Tax Preparation!

With our top-tier tax preparation outsourcing services, HWA Alliance of CPA Firms assists businesses in optimizing tax strategy and preparing returns correctly and on time. We have best-in-class professionals that are well-versed in tax return filing procedures, guaranteeing that your productivity and profitability rise through innovative tax planning strategies. Because of our proactive approach to tax strategy and preparation, you will go above and beyond traditional planning to save your company money and time.

Get high-quality strategic tax strategy, planning, and preparation at a fractional cost with us! Contact us today.