Tax-wise Generosity: Navigating the Maze of Charitable Giving and Tax Planning

Photo by Tima Miroshnichenko: https://www.pexels.com/photo/banknotes-and-calculator-on-table-6694543/

As tax planning season rolls around each year, many people think not just about their finances, but also about ways to give back through charity. Charitable giving offers a great opportunity to help society while also managing taxes effectively. This article delves into the basics of charitable giving and explores smart tax planning strategies that can enhance the benefits of your generosity.

By grasping the ins and outs of charitable giving and its impact on taxes, individuals can make their donations count not only in making a difference but also in gaining financial advantages. Join us as we explore these concepts and equip you with the knowledge and tools needed to navigate charitable giving with confidence and purpose.

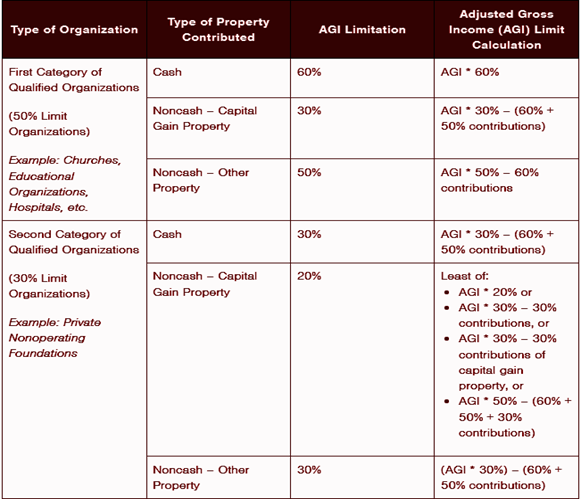

Limitations & Types of Property Contributed

When considering the deductions available for charitable contributions, it’s essential to understand the nuances involved. The deduction you can claim depends not only on the fair market value (FMV) of the donated property and the type of property donated but also on various other factors. For instance, the specific charity receiving the donation and any special circumstances surrounding the contribution can impact the deduction.

For example, if you donate cash, the deduction may be straightforward, but if you contribute appreciated securities, the tax benefits can be more complex. Additionally, donating personal property, such as artwork or vehicles, may have different deduction rules compared to donating financial assets like stocks or bonds. Furthermore, the timing of the donation can also affect the deduction. Donations made to certain types of charities or during specific time periods may qualify for enhanced deductions or other tax incentives.

Navigating these complexities requires careful consideration and possibly consultation with a tax advisor. Understanding the limitations and types of property contributed is crucial for maximizing the tax benefits of charitable giving while ensuring compliance with IRS regulations.

Check out the table below for a clear breakdown of the different restrictions and the order in which you can claim a charitable deduction. It’ll help you grasp the limitations and types of property you can contribute more easily.

https://www.forvis.com/forsights/2023/12/basics-of-charitable-giving-tax-planning-strategies

Tax Planning Strategies

After the Tax Cuts and Jobs Act of 2017, fewer people itemize their deductions on tax returns, potentially leading to charitable contributions providing no tax benefit. We’ll explore various tax planning strategies related to charitable giving that still offer tax benefits.

- Donating Appreciated Assets: Instead of selling appreciated assets like stocks or real estate and donating the cash, consider donating the assets directly. This way, you avoid paying taxes on the gains and still get a deduction for the full fair market value. If the contributed property is valued at $5,000 or more and not cash or publicly traded securities, you’ll need a qualified appraisal attached to your return, especially if claiming a deduction of $500,000 or more.

- Bunching Contributions: Some taxpayers save up donations for multiple years and give a lump sum in one year when it exceeds the standard deduction. For instance, instead of giving $10,000 annually, saving $10,000 per year for five years allows a $50,000 contribution in the fifth year, surpassing the standard deduction.

- Donor-Advised Funds (DAFs): Establishing a DAF allows you to contribute funds and advise the fund on when to distribute to charities of your choice. You receive a deduction when you contribute to the DAF, providing flexibility in charitable giving.

- Qualified Charitable Distributions (QCDs): Individuals aged 70.5 and older can donate up to $100,000 annually directly from their IRA to a charity. This satisfies required minimum distributions (RMDs), potentially reduces future RMDs, and excludes the donated amount from taxable income.

It’s crucial to ensure the receiving organization is qualified to accept QCDs. Starting in 2023, donors can make a one-time gift up to $50,000 to certain types of charitable trusts. Additionally, the QCD annual limit will be adjusted for inflation from 2024 onwards.

Required Minimum Distributions (RMDs)

Employer-sponsored retirement plans, including SEP or SIMPLE IRAs, and traditional IRAs, have a rule called Required Minimum Distributions (RMDs). This rule mandates that retirees withdraw a certain amount annually from their retirement accounts. The passing of the SECURE 2.0 Act in 2022 ushered in significant changes to RMD regulations. Let’s delve into the key alterations brought about by this legislation and their implications for retirees and their retirement savings.

● Starting in 2023, individuals now have until they turn 73 to begin taking their required RMDs. This age limit will increase to 75 by 2033.

● As of 2023, special needs trusts created for disabled beneficiaries and funded with inherited IRAs can now retain stretch RMDs over the lifetime of the chronically ill or disabled beneficiary.

● From 2024 onward, the requirement for pre-death RMDs in Roth 401(k) accounts has been removed. This change, which already applied to Roth IRAs, now also applies to Roth-designated accounts within employer plans.

● Also, in 2024, surviving spouses have the option to be treated as the plan participant for RMD purposes. This means they can delay the start of the distribution period until the age at which the deceased spouse would have been required to take RMDs (either 73 or 75, as mentioned earlier). This choice allows for a longer distribution period determined by the uniform lifetime table rather than the single life table.

Bottom Line

Mastering the dynamics of charitable giving and tax planning is essential for those aiming to make a difference while optimizing their financial outlook. By employing strategies like donating appreciated assets, utilizing bunching techniques, and exploring donor-advised funds and qualified charitable distributions, individuals can enhance their philanthropic impact while maximizing tax benefits. Staying abreast of legislative changes and adopting strategic approaches ensures a proactive and rewarding journey towards both financial security and social contribution.

Stay abreast with HWAA!

Ready to optimize your charitable giving and tax planning strategies? Trust HWA Alliance of CPA Firms to guide you through the process with expertise and personalized attention. Our team of experienced professionals is dedicated to helping you maximize your philanthropic impact while minimizing your tax liabilities. Contact us today to schedule a consultation and start building a brighter financial future for yourself and your community.